Traditional mortgages, mortgage refinancing, and reverse mortgages are all available through InterContinental Capital Group. It offers individualized service in 46 states and Washington, D.C. through registered mortgage professionals. The company holds a Title II Mortgagee license. However, it does not disclose precise charges on its website.

About InterContinental Capital Group

Intercontinental Capital Group Inc. (ICG) is a mortgage and reverse mortgage lender that provides solutions for qualifying first-time homebuyers, mortgage refinancing for current homeowners, and reverse mortgages for homeowners aged 62 and over.

ICG, a Title II Mortgagee licensed by the United States Department of Housing and Urban Development (HUD), provides clients around the country with government-insured Federal Housing Administration (FHA) home loans as well as typical conventional finance.

Applicants are partnered with local qualified mortgage professionals to help them navigate the process, ensuring that loans meet all state and municipal requirements.

InterContinental Capital Group loan services

Owners and purchasers can use InterContinental Capital Group to purchase a new house or refinance an existing mortgage. Homeowners who qualify can refinancing their mortgage to lock in lower monthly payments, and elderly can use their home equity to fund their retirement.

ICG Reverse Mortgage

Homeowners aged 62 and over may be eligible for a reverse mortgage, which allows them to access the equity in their house as a source of tax-free income. If you qualify, the home’s title will remain in your name, and you’ll have more financial flexibility because no monthly payments are necessary. You can then take advantage of investing opportunities or simply enjoy the extra money. Taxes, insurance, and homeowners association (HOA) expenses are still the responsibility of the owners (where applicable).

Refinancing with ICG

Homeowners, like the times, change. The loan you got when you bought your house might not be the best mortgage available right now. To see if refinancing is right for you, ICG experts look at industry trends and assess your existing financial condition. Lower monthly payments, greater credit scores, debt consolidation, and relief from the cost of private mortgage insurance are just a few of the advantages. Refinancing can also help you plan for home upgrades and become more financially comfortable in the long run.

ICG home mortgage

Prospective homeowners can benefit from competitive rates, fair terms, and the assistance of a knowledgeable loan officer throughout the process. Whether a homeowner is buying a property for the first time or not, ICG takes satisfaction in obtaining the best rates and terms. The staff works with customers to ensure that they understand the technical requirements of getting approved as well as the value of long-term planning as you progress toward financial independence.

InterContinental Capital Group customer service

ICG loan officers walk you through each step of your tailored loan procedure, from application to speedy closing. You can apply online or by phone, and a loan professional will assist you in choosing the appropriate program and interest rate.

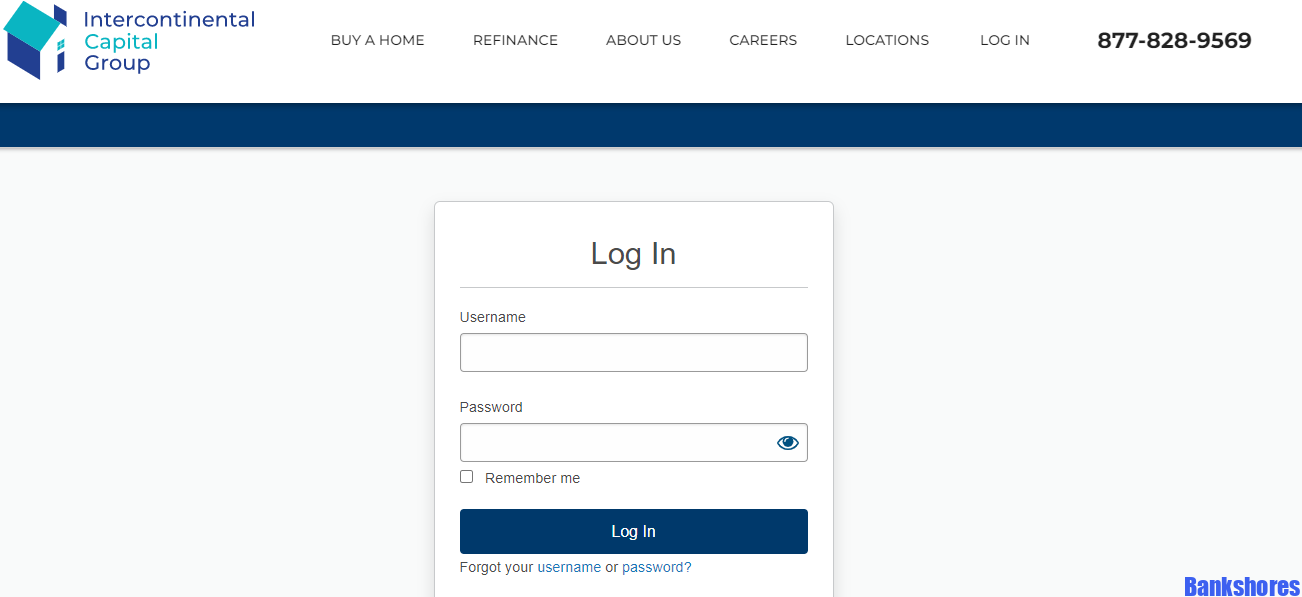

InterContinental Capital Group Login

For intercontinental capital group login, follow the steps below:

- Go to the official ICG portal login

- Enter your login details- username and password

- Click login

If you forgot any of your login details, username or password, just click the forgot username or password link, then enter your username and email address on record. A reset link will be sent to you after verification.

FAQS on InterContinental Capital Group Loans

How long does it take to close an InterContinental Capital Group mortgage loan?

Closing a loan might take anywhere from one to two months, depending on your lender, loan program, mortgage type, loan size, and property type. Other factors, such as market conditions, may also be relevant. ICG’s electronic loan center allows clients to track the progress of their loan, receive and sign disclosures, and upload evidence at any time.

Who is eligible for an ICG reverse mortgage loan?

A reverse mortgage with ICG is available to any homeowner over the age of 62. They must make their home their primary residence as well.

Where is InterContinental Capital Group available?

InterContinental Capital Group is a private equity firm with operations in 46 states and the District of Columbia.

What are InterContinental Capital Group’s rates?

ICG does not make its rates available to the public, but candidates are encouraged to fill out an application or contact to speak with an agent about their possibilities.

Is InterContinental Capital Group legitimate?

Yes, the United States Department of Housing and Urban Development (HUD) has granted InterContinental Capital Group a Title II Mortgagee license, allowing it to lawfully provide government-insured Federal Housing Administration (FHA) home loans.