How much money is sufficient?

That is a question that we have all pondered at some point. The findings of the research are as follows. How much money do we need to live a happy and enjoyable life without having a heavy financial burden hanging over our heads? You might now find that you require considerably less than you did a few years ago.

How Much Money According to Research Is Enough?

Despite popular belief, research suggests that it may be possible to purchase happiness.

How much money do you, therefore, need to survive?

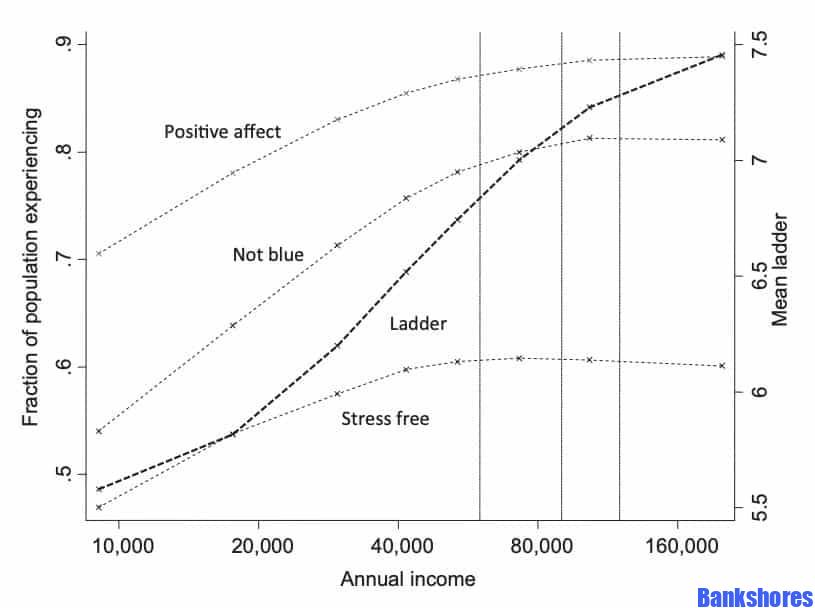

D. Kahneman and A. Deaton conducted a study in 2010 to determine whether income has an impact on how well-being emotionally and personally is assessed.

They divided emotional health into quantifiable areas like joy, stress, sadness, rage, and affection as measures of how enjoyable your life is or is not. Personal life evaluation was used to describe how someone views their own life. The study found that stress, feeling down, melancholy, and worry—all components of emotional wellbeing—decreased as household earnings rose.

The study found a sweet spot of $75,000 gross annual income where emotional health and personal life appraisal soared.

They discovered that well-being stopped increasing after $75,000 and started to level off, showing that larger salaries did not enhance the sample group’s enjoyment or quality of life. It’s crucial to keep in mind that this study was completed ten years ago. Inflation and the economic environment have altered since then. Over the previous ten years, inflation has increased by 18.33%. So it makes sense to say that the sweet spot for money that will maximize our happiness is roughly 18.33% more than the $75,000 from ten years ago.

Source: High income improves evaluation of life but not emotional well-being

In the current economic context, it is reasonable to state that an ideal income would be around $88,747.50 (yeah, I’m sure that 50 cents will make all the difference in your life).

What Amount Of Money Is Needed To Live?

So, how much cash is sufficient? Can we rely on research?

Although the aforementioned study provides us with a general idea of how much we need to live at our highest possible level of comfort and enjoyment, it is crucial to remember that each state is unique.

State-to-state differences in taxes and cost of living are significant. Evidently, earning $88,000 year will buy you a lot more modest lifestyle if you reside in New York City than it would in Houston, Texas. You can use a cost of living calculator to see how much money you would need to earn in a different state to maintain the same standard of life as you do today.

What Is a Fair Wage?

A decent salary is one that allows you to cover all necessary costs, save for retirement, pay off a mortgage, and have some money left over for a few wants.

Additionally, it involves generating that revenue in a time frame that gives you some free time to enjoy activities other than earning money, including spending time with friends and family.

If your new income target is $88,000, you should start thinking about ways to increase it. Developing your skill set will benefit you in the future, whether it be through a side business or upgrading your education through evening classes. You’ll feel more confident and get access to new opportunities as a result.

How can I increase my income without increasing my stress?

Identifying the amount of money you need to live comfortably and happily may be a smart idea at this time.

Finding additional money while avoiding the strain and stress that comes with it can be difficult.

American stress levels were revealed by data from the Gallup World Poll. Stressed, by the way, I mean! Out of 151 nations, we actually come in fifth place for having the highest levels of stress.

“Savings, not income, is what matters”.