No doubt you are here because you are interested in the answer to the question, How Do I Know If I Have Gap Insurance? Before we go ahead and do justice to that, first we need to briefly answer the questions, What is Gap Insurance? We would also discuss how long does it take for gap insurance to pay?

What is Gap Insurance?

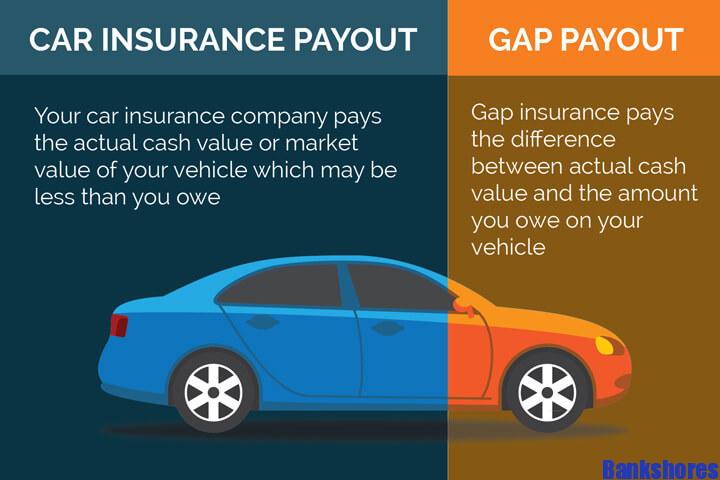

Gap insurance is a type of coverage that you can purchase to protect yourself when purchasing a new vehicle. Its purpose is to bridge the gap between the amount your auto insurer would pay out if your car was stolen or written off and the amount you purchased for it.

Assume you’ve just spent £25,000 on a car or taken out a loan for that amount. You drive the car home, and it’s either stolen or written off in an accident a week later.

Your car insurance company issues you a $15,000 check. You paid £25,000 to the dealer, but according to the insurer’s calculations, the car is only worth £15,000 because autos depreciate so quickly.

This leaves you £10,000 in debt to your car credit company for a car you no longer own, or even worse, potentially in debt to your car finance company for £10,000 (plus interest).

When your car is totaled, ‘Gap’ insurance (short for Guaranteed Asset Protection) is designed to supplement your standard car insurance by covering the gap between what they will pay and what you’ll need to get back on the road.

Will Gap insurance Replace my car?

Your car will not be directly replaced if you have gap insurance.

Instead, depending on the sort of insurance you choose, it will ensure that you have the funds necessary to pay off your debt or replace your vehicle with one of the same make and model.

It can also assist in bridging the gap between what your primary insurer paid and what you spent to purchase the vehicle in the first place.

How Do I Know If I Have Gap Insurance?

GAP insurance, unlike liability insurance, is not required by the state. If you want GAP insurance for your car, you’ll need to ask for it or look for it and add it to your existing coverage.

If you lease a car, GAP insurance may be necessary, and this should be specified in your leasing agreement.

If you’re wondering, “How do I know if I have GAP insurance?” your best bet is to contact your insurer or the dealership where you bought or leased your car.

Where can you buy Gap insurance?

If you have used our guide on How Do I Know If I Have Gap Insurance? and you are sure you don’t then you may need to buy.

Many people first learn about Gap insurance at a car dealership, where it’s frequently sold as part of a package of ‘extras’ that salespeople try to persuade you to buy.

Although gap insurance is a valuable product, your dealership may not be the best place to get it. It’s often more cheaper online, where it’s sold directly by insurers and brokers or through comparison sites.

The Financial Conduct Authority (FCA) established restrictions in 2015 after becoming concerned that dealerships were offering costly Gap insurance to consumers who were distracted by car-buying talks.

Before you acquire a policy, dealers providing Gap insurance must notify you the following:

- The sum total of the Gap insurance premiums

- The policy’s duration

- The product’s features, benefits, unexpected exclusions, and limitations

- That the product can be purchased from independent vendors elsewhere

- Is Gap insurance an optional or mandatory add-on to the vehicle purchase?

Furthermore, dealerships are no longer permitted to sell you Gap insurance on the same day that they sell you a car. Unless you want to waive the waiting time, you must take at least a two-day pause.

If you wait two days or more, the provider should go over the policy details once more. The choice to waive the waiting period must be made by you; the dealership cannot advise you.

Which Gap insurance policy is best for you?

There are a variety of Gap insurance products available, each with its own twist – or combination of coverage – from different providers.

While some are more basic than others, they all serve distinct functions, thus the best one for you will depend on your needs.

Finance Gap Insurance

This is one of the most basic plans on the market (and is sometimes included with other types of Gap cover), and it helps you pay off any outstanding loan payments on your car if it is written off.

Payments for negative equity, on the other hand, are normally excluded. See the list below.

Negative Equity Gap Insurance

The difference between your finance settlement (the amount you’ve borrowed) and the cost of your car is known as ‘negative equity.’

If you part-exchanged a previous car before paying off its finance, the leftover debt from that loan will be transferred to your present car. This older debt will not be covered by a Finance Gap insurance payout. Gap Insurance for Negative Equity will.

Return to invoice Gap Insurance

Return to invoice Gap insurance covers the difference between your car insurer’s claim settlement and the price you paid for it.

Vehicle replacement Gap insurance

Vehicle replacement cover bridges the gap between your auto insurance payout and the cost of replacing your vehicle with a new one, rather than helping you reach the price you paid for it.

Return to value Gap insurance

Return to the original value Gap insurance is similar to return to invoice Gap insurance in that it pays the difference between your auto insurance payout and the value of the vehicle when it was first acquired, rather than helping you get exactly what you paid for the car.

If you bought the automobile used or if you’ve had it for a long time, this could come in handy.

Lease gap insurance

If you leased your automobile rather than buying it outright, lease Gap insurance will assist you pay off the remaining balance of your contract as well as any fees associated with terminating your loan early.

When is Gap insurance is needed?

We believe Gap insurance can be beneficial and should be considered, but it is not appropriate for everyone.

Under general, Gap is likely to be beneficial in the following circumstances:

- You bought your car with a big debt

Gap insurance can help you pay off your car’s outstanding debt, which means you won’t have to keep making payments if your car is stolen or destroyed beyond repair.

- You’re concerned about your vehicle’s depreciation

In the event of a total loss, the faster your automobile loses value, the less your insurer will pay in comparison to what you purchased for it. You’ll get more money if you have gap insurance.

- Your car is on a long term Lease

A write-off might leave you without a car and a charge for thousands of pounds if you have a long-term rental agreement for a vehicle with a mileage allowance. This is something that gap insurance can help with.

How to claim on your Gap insurance

You can file a Gap insurance claim once your auto insurer has awarded you a compensation.

However, it’s a good idea to check your Gap insurance terms and conditions ahead of time to see whether there are any time constraints for filing a claim, what your excess is, and what information you’ll need.

Get in touch with your Gap company over the Phone

Before you accept any settlement from your auto insurance provider, it’s best to talk to your Gap insurer. Before consenting to a claim, several Gap providers demand that you speak with them.

If your Gap insurance policy includes financing, talk to your agent about how any outstanding loans will be handled and whether they will be paid on your behalf automatically.

Are you dissatisfied with the outcome? Complain

Don’t be hesitant to file a complaint if your Gap insurer fails to handle your issue fairly and promptly. Your policy document should include instructions on how to achieve this.

If your claim has not been resolved after you’ve exhausted the insurance company’s complaints system, contact the Financial Ombudsman Service (FOS).

You normally have six months to file a complaint after reaching an impasse with the insurance.

Gap Insurance FAQs

Is Gap Insurance Worth the Money?

Gap insurance is absolutely worth the money if you owe more on your car than it is now worth at any point in time.

If you put down less than 20% on a car, you should consider getting gap insurance for at least the first couple of years. You should owe less on the car than it is worth by that time. If the automobile is totaled, you won’t have to pay the difference between the insured value of the car and the amount you owe a lender out of pocket.

If you take advantage of a dealer’s periodic car-buying incentive, gap insurance is very valuable. If you receive a bargain with a modest down payment and three months “free,” you’ll almost certainly be in default on your loan for a long time.

Do I Need Car Gap Insurance If I Already Have Full Coverage?

The term “comprehensive” refers to a policy that provides complete coverage. It includes accident coverage as well as coverage for any unforeseen event that could cause an automobile to be destroyed, such as vandalism or a flood. However, it only covers the car’s real cash value, not the price you purchased for it or the amount you owe on the loan.

The difference is covered by gap insurance.

So, if there is a difference between what you owe and what the automobile is worth on a used car lot, you’ll require gap insurance. This is most likely to happen during the first few years of ownership, when your new car depreciates faster than your loan debt decreases.

Once your loan debt is low enough to be covered in full by a collision insurance payment, you can cancel the gap insurance.

What Does Gap Insurance Do?

Consider it an extra layer of protection for your car loan. The gap policy will cover the difference if your automobile is totaled and your comprehensive auto insurance policy pays less than what you owe the lender.

How long does it take for gap insurance to pay?

After a claim, your motor insurer may wait anywhere from five to 45 days to pay out gap insurance. The actual period of time depends on the complexity of your claim as well as state rules. Typically, your insurance company will send these payments directly to your lienholder or lessor.

How Do I Get Gap Insurance?

Ask your motor insurance company if they can add it to your existing coverage. This is the simplest and probably cheapest option. To make sure you’re getting the best bargain, you may compare rates online.

A gap coverage will almost undoubtedly be offered by the dealership, but it will almost surely be more expensive than one offered by a big insurer. In any case, double-check that your vehicle isn’t already covered by gap insurance. Gap coverage is frequently included in the cost of auto leases.

Can You Get Gap Insurance After You Buy a Car?

Yes. Your best bet is to contact your auto insurance company and inquire about adding it to your current coverage. Your insurer should be able to explain your alternatives and estimate the cost of adding gap coverage. Make sure to shop around for the greatest car insurance quotes to obtain the best deal.