So you are ready to apply for a credit card and you are looking for information on Verve Credit Card Application. This article also provides guidance on Verve credit card login, how to make bill payments, and how to retrieve your lost or forgotten password for the online portal.

Verve Credit Card

Continental Finance runs and manages the Verve Credit Card, which is issued by Bank Of Missouri. For people with bad credit, this card is a lifesaver. Anyone with terrible credit can apply for this card, which allows them to enhance their Transunion credit score by reporting to three of the country’s major credit bureaus.

Paying your bills on time not only improves your credit score, but it also allows you to get greater credit card spending limits because the company analyses credit card limitations every six months. In a nutshell, the Verve Credit Card application is the miracle cure for your financial woes.

Features of Verve Credit Card

Initial Credit Limit ranges from $300 to $1,000

A Verve Mastercard® with a credit limit ranging from $300 to $1,000 at first. Use your Verve card at any location that accepts Mastercard. With your new Verve credit card application approved, you can go shopping, eat out, and even travel. When you make on-time payments and keep your balance below your credit limit, your Verve credit card account can help you rebuild or enhance your credit score.

Potential Credit Limit Increase After Just 6 Months

After only 6 months, you may be eligible for your first credit limit increase. Getting a credit limit increase is a big step in the right direction if you’re seeking to improve your credit. Continental understands this and will assess your account, allowing you to request a Credit Limit Increase, subject to income and underwriting conditions at the time of review. You could benefit from increased spending power, a lower credit utilisation ratio, and the possibility of improving your credit score.

Enjoy Peace of Mind With $0 Fraud Liability

You won’t be held liable for illegal charges on your Verve credit card if you have $0 Fraud Liability. You are only liable for transactions that you make with no risk of fraud, so you can shop with confidence knowing that your card activity is completely secure. Continental Finance will protect your Verve credit card account whether you’re buying in a store, travelling overseas, or making online transactions.

Monthly Reporting to All Three Major Credit Bureaus

The Verve credit card is a useful instrument for establishing credit. Continental Finance welcomes clients with less-than-perfect credit who apply for a Verve credit card. Continental Finance will report your payments to TransUnion, Experian, and Equifax, the three major credit bureaus.

Free Monthly Credit Score

You must create an account in order to activate a Verve Mastercard. When you sign up for e-statements, one of the best aspects of that account is that you get a free monthly credit score. You can check your score once a month. You can see the impact of actions like making your monthly payments on your credit score each month if you’re developing credit for the first time or repairing credit.

Verve Credit Card Application

Verve credit card application ahs never been easier. You can apply for a Verve credit card online, by calling 1-866-513-4598, or by mailing back the acceptance certificate from the pre-selected offer you received in the mail.

Some basic information will be necessary to apply for a credit card online, over the phone, or by mail.

To apply for a Verve credit card, we’ll need your entire name as it appears on official papers, your social security number, your date of birth, and your physical address. A post office box will not suffice. When applying for a major credit card, this is a typical occurrence. This personal information is required for two purposes.

First, to gather, verify, and record information that identifies each person who registers a Verve card account with us, as required by federal law. As a result, your personal information is necessary and will be used to identify you.

Second, they pull your credit bureau data using your personal information, such as your Social Security number. To process your application, this information is combined with additional information such as your monthly salary.

After your Verve Credit Card Application have you will get your credit card within 3 business days.

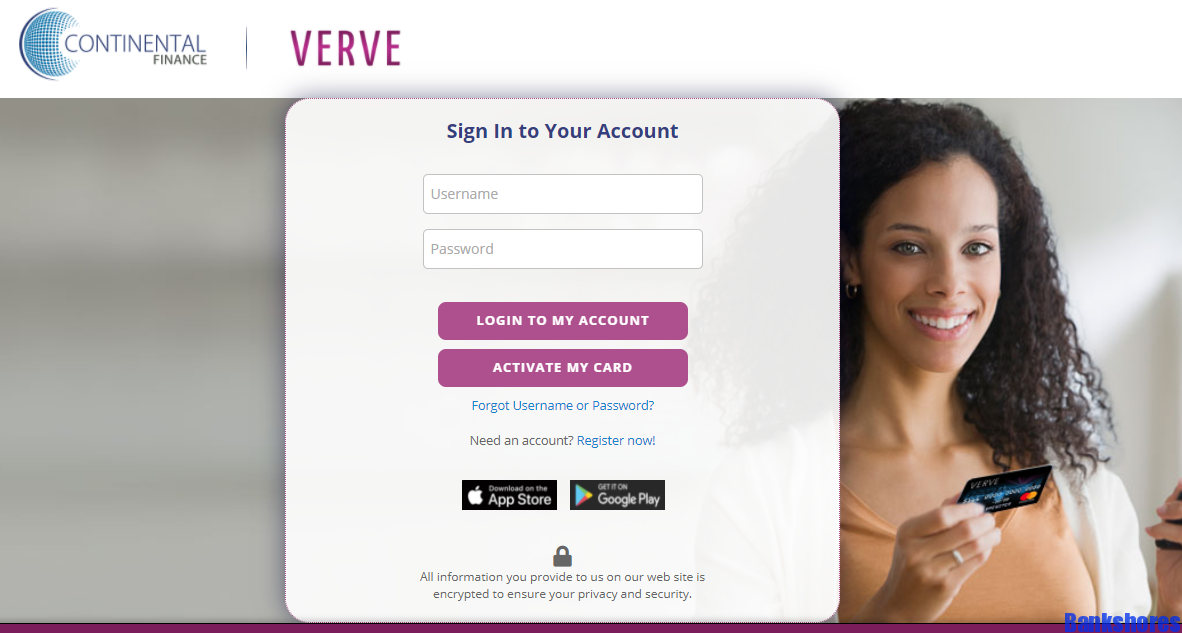

Verve Credit Card Login

Always begin with the first step. The Most Difficult, certainly, because an oblivious attitude toward opening your card’s portal could find you in the worst situation of your life. Many cloned portals are meant to catch you and grab all of your personal information. To securely connect into your credit card account online, follow the procedures outlined below.

You can access the verve credit card login portal in one of two ways.

Step 1: Go to the Continental Finance website first. “www.continentalfinance.net” is the website’s URL.

Step 2: On the top right side of the page, choose the “Portal” tab, then select the Verve credit card from the dropdown menu that displays, and then click “Go To Portal.”

Step 3: Now that you’ve arrived at the Verve credit card login page, click on the Login tab in the top right corner of the screen.

Step 4: To access your account, enter your username and password and click the Login button. You can also enter these details directly on this link https://www.vervecardinfo.com/

Verve Credit Credit Card Login Password Reset

By following the company’s prescribed processes, you can reclaim your lost account or change forgotten passwords. We’ll walk you through the process step by step.

Step 1: Complete step 3 of the above-mentioned login method.

Step 2: On the Verve credit card Sign In page, just below the Login button, there is a link that says “Forget Username or Password?” Click it.

Step 3: On this screen, you’ll see two alternatives. one for the username and another for the password reset Depending on what you wish to retrieve, select one of the options.

Step 4: If you select “I forgot my username,” you will be directed to a page where you must authenticate your identity. Give us the last four digits of your card, the last four digits of your SSN, and your birth date/5-digit zip code. Then, below the form, click the “Lookup Account” link.

Step 5: On the next page, fill in all of the required information.

Step 6: If you select “I Forgot My Password,” you will be directed to a page that asks for your username. After you’ve entered your username, click submit.

Step 7: You will receive an email with password reset instructions to your registered email address.

Step 8: Open the email and click the link provided. Follow the instructions.

Verve Credit Card Payment

Using an online account – Go to the payment section of your online account to clear your current dues.

Using a phone number — Dial 1.800.518.6142 to speak with a bank representative. After that, the agent will assist you with the payment process. Before you contact, make a note of your account and credit card details.

Using a Mobile App — Download the bank’s credit card apps from the Google Play and Apple App Stores. Pay your current dues by logging in using the app. In the sections below, you’ll find a link to the mobile app.

How to Create Verve Credit Card Online Account

Verve Credit Card Application is done right, now you need register for the verve credit card’s login page before accessing all of the options offered to you. It is really simple to register. The following is a step-by-step procedure.

Step 1: On the sign-in screen, click the “Register now” link directly below the login button.

Step 2: On the “Lookup Account” page, enter the last four digits of your Verve Credit Card, the last four digits of your SSN, and your Birthdate/Zip code.

Step 3: To create a username and password, follow the instructions on the screen.

Verve Credit Card Application Mobile Login

This card was created for people with bad or low credit scores in mind. However, this does not prevent the corporation from offering all of the high-end amenities to its customers. By installing the app to your mobile device, you may manage all of your financial operations on the move, such as monitoring recent transactions, making payments, and checking your statements. We’ve provided a link to download the app below for your convenience.

-

For Android devices – CFC Mobile Access – Apps on Google Play.

-

For Apple devices – https://apps.apple.com/us/app/cfc-mobile-access/id1248074910#?platform=iphone

Verve Credit Card Customer Service

Customer service phone 1-866-449-4514

To report a Lost or Stolen Credit Card please call 1-800-556-5678